If you’re reading this blog, there is a good chance that you are interested in financial independence retire early. More specifically, you are looking to invest in dividend growth stocks and live off dividends when you are retired.

Many Canadian dividend stocks pay quarterly dividends and you can find their payment dates in the Canadian dividend calendar. This can lead to some months with bigger dividend payments and some months with smaller or very little dividend payments.

By coincidence, we had a very stable monthly dividend income from 2016 to 2018. But this stable monthly dividend income went away as we added more and more quarterly payers. As a result, our monthly dividends in the last couple of years have been lumpier.

Depending on your situation, some investors may prefer a more regular monthly dividend income rather than lumpy dividend payments. These investors often look for Canadian dividend stocks that pay monthly dividends rather than quarterly dividends.

Fortunately, there are many Canadian dividend stocks that pay monthly dividends, including many of the Canadian REITs. What are some of the best Canadian monthly dividend stocks? Let’s find out.

Canadian monthly dividend stocks

Most Canadian dividend stocks pay quarterly dividends. So Canadian monthly dividend stocks are slightly rare, but that doesn’t mean they do not exist. Here are some of the Canadian monthly dividend stocks, including REITs and income trusts.

Please note, this isn’t an exclusive list since it is very difficult to go through the entire TSX and TSX Venture to pick out all the stocks that pay monthly dividends.

| Ticker | Company | Sector | Dividend Streak | Yield |

| AI | Atrium Mortgage Investment Corp | Financial Services | 0 | 6.25% |

| ALA | AltaGas | Utilities | 0 | 3.84% |

| AP.UN | Allie Properties REIT | REIT | 9 | 4.12% |

| APR.UN | Automotive Properties REIT | REIT | 0 | 6.07% |

| AW.UN | A&W Revenue Royalties Income Fund | Consumer Services | 0 | 4.67% |

| AX.UN | Artis REIT | REIT | 0 | 5.11% |

| BDGI | Badger Infrastructure Solutions Ltd | Industrials | 5 | 1.73% |

| BDT | Bird Construction Inc. | Industrials | 0 | 3.83% |

| BEI.UN | Boardwalk REIT | REIT | 0 | 1.98% |

| BPF.UN | Boston Pizza Royalties Income Trust | Consumer Services | 0 | 6.81% |

| BRE | Bridgemarq Real Estate Services Inc | REIT | 0 | 8.05% |

| CAR.UN | Canadian Apartment Properties | REIT | 9 | 2.42% |

| CEU | CES Energy Solutions | Energy | 0 | 8.77% |

| CHE.UN | Chemtrade Logistics Income Fund | Materials | 0 | 7.38% |

| CHP.UN | Choice Properties | REIT | 0 | 4.95% |

| CHW | Cheesewood Gropu Ltd | Financial Services | 0 | 3.01% |

| CRR.UN | Crombie REIT | REIT | 0 | 4.88% |

| CRT.UN | CT REIT | REIT | 8 | 4.79% |

| CSH.UN | Chartwell Retirement Residences | REIT | 8 | 5.17% |

| CUF.UN | Cominar REIT | REIT | 0 | 3.53% |

| D.UN | Dream Office REIT | REIT | 0 | 4.17% |

| DIR.UN | Dream Industrial REIT | REIT | 0 | 4.23% |

| EIF | Exchange Income Fund | Industrials | 10 | 5.10% |

| ERE.UN | European Residential REIT | REIT | 0 | 3.72% |

| ERF | EnergyPlus Corp | Energy | 0 | 1.30% |

| EXE | Extendicare | Healthcare | 0 | 6.63% |

| FCR.UN | First Capital REIT | REIT | 9 | 2.38% |

| FN | First National Financial Corporation | Financial Services | 9 | 5.12% |

| FRU | Freehold Royalties Ltd | Energy | 0 | 5.09% |

| GRT.UN | Granite REIT | REIT | 10 | 3.16% |

| GWR | Global Water Resources Inc | Utilities | 7 | 1.63% |

| HR.UN | H&R REIT | REIT | 0 | 4.18% |

| IIP.UN | Interrent REIT | REIT | 9 | 1.89% |

| KBL | K-Bro Linen Inc | Business Services | 0 | 3.19% |

| KEG.UN | KEG Income Trust Fund | Consumer Cyclical | 0 | 7.40% |

| KEY | Keyera Corp | Energy | 10 | 5.83% |

| KMP.UN | Killam Apartment REIT | REIT | 4 | 3.15% |

| MI.UN | Minto Apartment REIT | REIT | 0 | 1.99% |

| MRG.UN | Morguard North American Residential | REIT | 5 | 4.01% |

| MRT.UN | Morguard Real Estate | REIT | 0 | 4.20% |

| MTL | Mullen Group Ltd | Energy | 0 | 3.40% |

| NET.UN | Canadian Net REIT | REIT | 9 | 3.88% |

| NHF.UN | Northview Canadian High Yield Residential | REIT | 0 | 7.80% |

| NPI | Northland Power Inc. | Utilities | 0 | 2.92% |

| NWH.UN | Northwest Healthcare | REIT | 0 | 6.02% |

| PKI | Parkland Corporation | Energy | 8 | 3.25% |

| PLC | Park Lawn Corporation | Consumer Cyclical | 0 | 1.23% |

| PLZ.UN | Plaza Retail REIT | REIT | 0 | 6.07% |

| PZA | Pizza Pizza Royalty Corp | Consumer Cyclical | 0 | 6.27% |

| REI.UN | RioCan REIT | REIT | 0 | 4.22% |

| RNW | TransAlta Renewables Inc. | Utilities | 0 | 4.80% |

| RPI.UN | Richards Packaging Income Fund | Industrials | 0 | 2.12% |

| SGR.UN | Slate Grocery REIT | REIT | 7 | 8.18% |

| SIS | Savaria Corporation | Industrials | 8 | 2.54% |

| SJR.B | Shaw Communications | Communication Services | 0 | 3.26% |

| SMU.UN | Summit Industrial REIT | REIT | 4 | 2.52% |

| SOT.UN | Slate Office REIT | REIT | 0 | 7.63% |

| SPB | Superior Plus | Utilities | 0 | 5.19% |

| SRU.UN | SmartCentres REIT | REIT | 7 | 6.01% |

| TF | Timbercreek Financial Corp | Financial Services | 0 | 7.05% |

| TNT.UN | True North Commercial REIT | REIT | 0 | 7.97% |

| WCP | Whitecap Resources Inc. | Energy | 0 | 3.52% |

As you can see, many of these monthly payers are REITs. So if you’re looking for a more stable monthly dividend income, it is necessary to invest in REITs.

Another thing to note is that many of these monthly payers haven’t consistently raised dividends. 44 companies out of 63 listed above (69.8%) have a zero-year dividend streak and only 3 companies have a dividend streak of more than 10 years.

There are also a few stocks that pay an extremely high dividend yield. For example, CES Energy Solutions, Bridgemarq Real Estate Services, and Slate Grocery REIT all yield over 8%. When a stock’s yield is above 5%, you must be more careful as a dividend investor.

Remember, the higher the yield, the higher the risk. Don’t get sucked into a yield trap!

Best Canadian monthly dividend stocks – My Top 9

Out of the 65 Canadian monthly dividend stocks listed above, what are my top 9 picks of the best Canadian monthly dividend stocks? For my picks, I used the following selection criteria – dividend yield, dividend safety, dividend growth, dividend streak, and future growth.

1. SmartCentre REIT (SRU.UN)

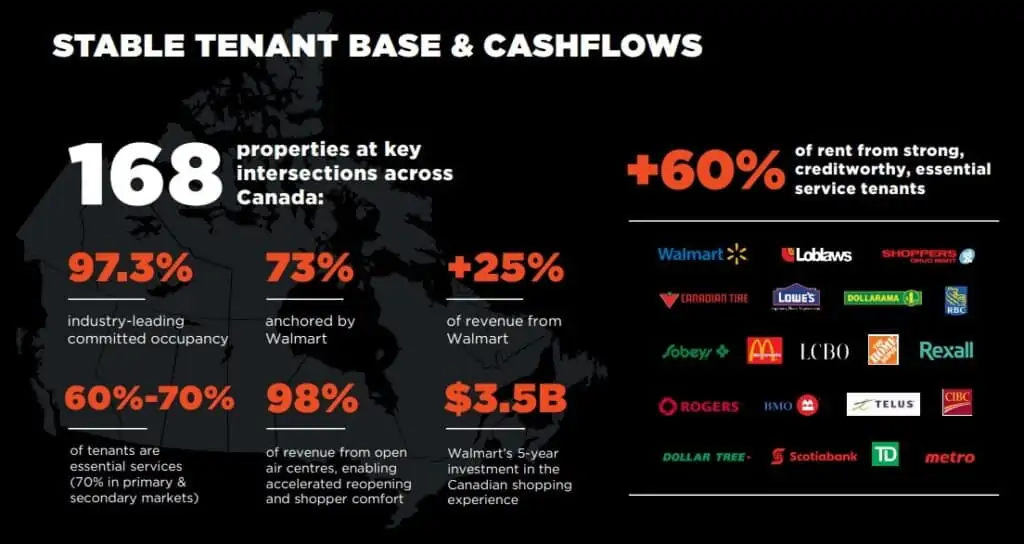

SmartCentres REIT is one of Canada’s largest fully integrated REITs, with a portfolio featuring 168 strategically located properties in communities across the country. The company has $10 billion in assets and owns 34.2 million square feet of income producing value-oriented retail space with an industry-leading occupancy rate of 97.3%, on 3,500 acres of owned land across Canada.

Unlike its competitors like RioCan REIT, SmartCentre REIT had kept its dividend payout throughout the pandemic and didn’t cut its distributions. This shows SmartCentre has good tenants that continue to pay rent despite the hard time.

- Sector: REIT

- Dividend Yield: 6.01%

- Payout Ratio: 84.5% (12- month rolling ACFO payout ratio)

- 5 Year Dividend Growth Rate: 2.8%

- Dividend Increase Streak: 7 years

- Number of Years of Dividend Increase in past 25 years: 13

Walmart is a big tenant for SmartCentre REIT with 73% of its properties anchored by Walmart and more than 25% of revenue from Walmart. Why did I mention Walmart? Stability. As you may have noticed, once a Walmart location is opened, it typically stays there for a very long time. It is extremely unusual for Walmart locations to close.

While the dividend growth rate is very low, it is compensated by the higher than normal initial yield. I think SmartCentre REIT is a great pick if you want to get into the retail REIT space.

2. First National Financial Corp (FN.TO)

When you think about mortgages, you typically first think of Canadian banks as lenders. You might be surprised to learn that there are other lenders out there other than the banks.

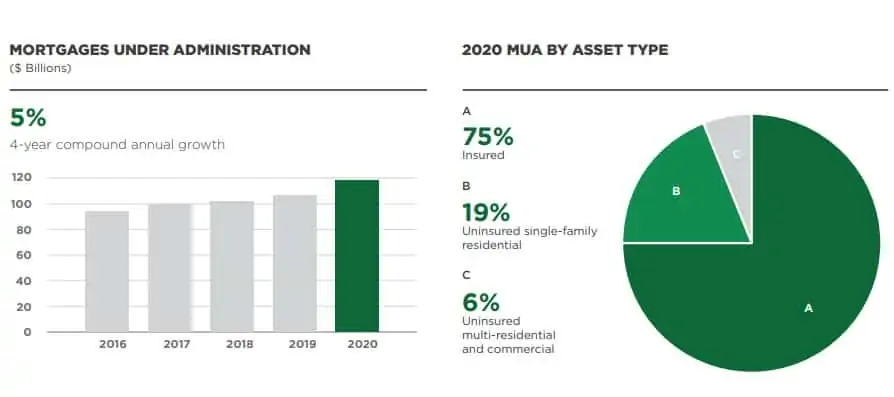

First National Financial Corp is one of Canada’s largest non-bank mortgage lenders, offering both commercial mortgages and residential mortgage solutions. Launched in 1988, First National has grown into more than 1500 team members with five regional offices in Vancouver, Toronto, Calgary, Montreal, and Halifax.

- Sector: Financial Services

- Dividend Yield: 5.11%

- Payout Ratio: 57.8%

- 5 Year Dividend Growth Rate: 5.5%

- Dividend Increase Streak: 9 years

- Number of Years of Dividend Increase in past 25 years: 13

In 2020, First National served over 342,000 Canadians in either commercial or residential mortgages, an increase of 10% from 2019. Mortgage under administration (MUA), the source of most of FN’s earnings, was over $118 billion in 2020.

Potential investors will be delighted to hear that over 75% of the MUA are insured with 19% of single-family residential and 6% of multi-residential and commercial are uninsured.

3. Chartwell Retirement (CSH.UN)

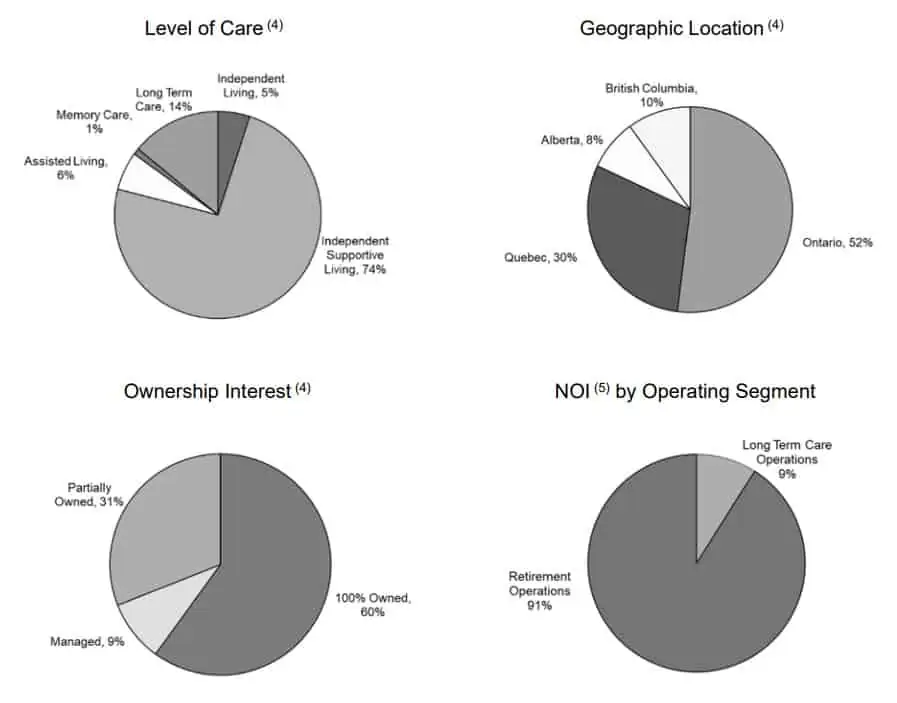

Chartwell Retirement Residences is an unincorporated, open-ended real estate trust which indirectly owns and operates a complete range of senior housing communities, from independent supportive living through assisted living to long term care. It is the largest operator in the Canadian senior living sector with over 200 retirement communities in BC, Alberta, Quebec, and Ontario.

- Sector: REIT

- Dividend Yield: 5.17%

- Payout Ratio:77.3% (AFFO payout ratio)

- 5 Year Dividend Growth Rate: 22.4%

- Dividend Increase Streak: 8 years

- Number of Years of Dividend Increase in past 25 years: 11

The COVID-19 pandemic has put a strain on Chartwell but the company has emphasized keeping the residents and their families safe. In fact, 96% of the residents and 95% of the family members that responded to Chartwell’s “Listening to Serve you Better” survey stated that they felt Chartwell took important steps to keep them safe throughout the pandemic. 94% of the family members have stated that their loved ones were safe living at a Chartwell residence.

Just like Savaria, I believe Chartwell will benefit from the ageing Canadian population and continue to grow its dividends.

4. Savaria Corporation (SIS.TO)

Savaria Corporation is a global leader in accessibility. The company manufactures products and modifications such as stairlifts and wheelchair conversion kits that help people maintain their personal mobility, whether it’s in the home, in a public space, or in a vehicle. As the average Canadian population gets older, Savaria is in a great position to benefit from the ageing population.

- Sector: Industrial

- Dividend Yield: 2.54%

- Payout Ratio: 96.8%

- 5 Year Dividend Growth Rate: 2.1%

- Dividend Increase Streak: 6 years

- Number of Years of Dividend Increase in past 25 years: 9

What makes Savaria very interesting from a monthly dividend income point of view is the high dividend growth rate. The company has an eight-year dividend increase streak with a 15-year dividend growth rate of 21.5% and a 10-year dividend growth rate of 18.7%. The dividend growth rate has “slowed” down to a still impressive 17.8% in the last three years.

Although the one-year dividend growth rate is only 7.7%, I believe this was a result of the global pandemic. With a free cash flow payout ratio of 52%, the company should be able to continue to raise its dividends at an impressive rate once the pandemic economic uncertainties are over.

In other words, if you want to categorize Savaria, it would fall under the low yield but high growth dividend stock category. I believe long term investors will be rewarded holding Savaria.

5. Granite REIT (GRT.UN)

Granite REIT is a Canadian-based real estate investment trust engaged in the acquisition, development, ownership management of logistics, warehouse and industrial properties in North America and Europe.

GRT.UN’s portfolio consists of 118 investment properties representing almost 51.3 million square feet of leasable area with an occupancy rate of 99.6%. When it comes to REITs, it is always a good thing to have some geographical diversification. Investors will be happy to hear that Granite REIT is globally diversified with properties located across nine different countries.

- Sector: REIT

- Dividend Yield: 3.16%

- Dividend Payout Ratio: 78% (AFFO payout ratio)

- 5 Year Dividend Growth Rate: 4.8%

- Dividend Increase Streak: 10 years

- Number of Years of Dividend Increase in past 25 years: 12

I really like Granite REIT because of its global footprint with a focus on institutional-quality assets in key distribution and e-commerce markets. Given that online shopping is more and more popular, stores like Amazon, Wayfair, and Walmart all need warehouses to store all the merchandise. This is one of the key reasons why I listed Granite REIT as one of the best Canadian dividend stocks.

6. CT REIT (CRT.UN)

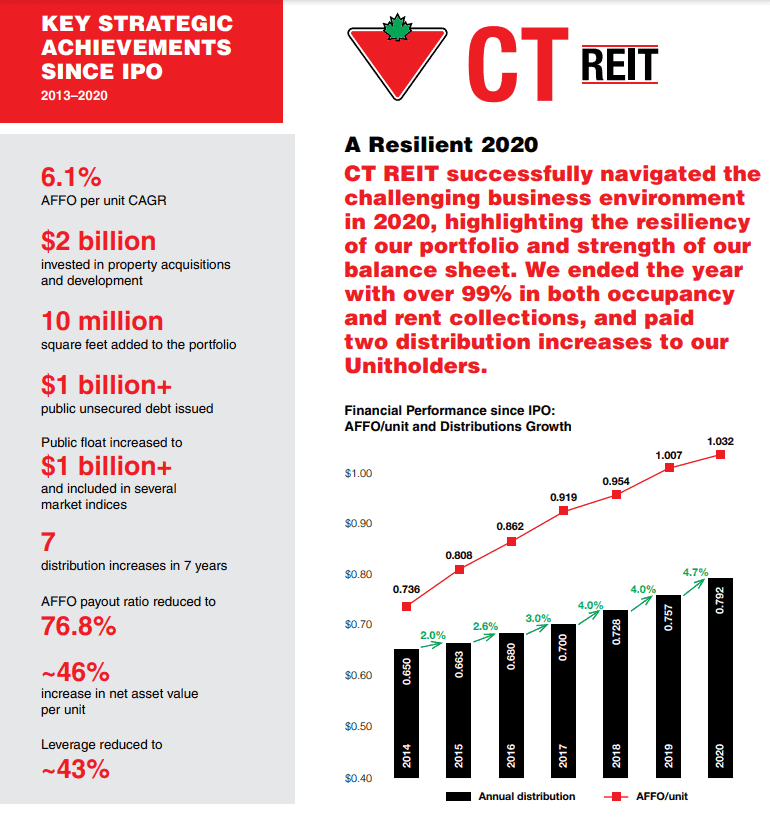

CT REIT owns a Canada-wide portfolio of high quality assets leased primarily to Canadian Tire Corporation with annual rental growth built into long term leases. This relationship is very unique because it gives CT REIT insight into Canadian Tire Corp’s long term plans and allows CT REIT to shape its strategy and plans accordingly.

This tightly knitted relationship also means CT REIT has been able to successfully navigate the challenges the COVID-19 pandemic has caused. CT REIT ended 2020 with over 99% in both occupancy and rent collections and managed to pay two distribution increases to shareholders. Considering many REITs were forced to cut dividends throughout the pandemic, this was a very impressive feat.

- Sector: REIT

- Dividend Yield: 4.78%

- Dividend Payout Ratio: 73.1% (AFFO payout ratio)

- 5 Year Dividend Growth Rate: 3.6%

- Dividend Increase Streak: 8 years

- Number of Years of Dividend Increase in past 25 years: 7 (note: CT REIT hasn’t been around for that long)

As of June 30, 2021, CT REIT had 923,000 square feet of gross leasable area under development with 95% of these committed to lease agreements. These developments represent an investment of approximately $280 million once completed and will allow for further CT REIT expansion and growth.

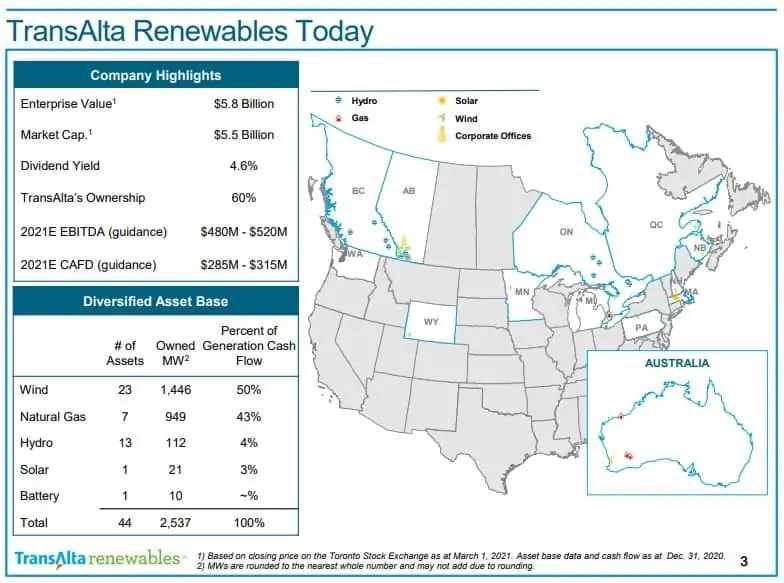

8. TransAlta Renewables Inc (RNW.TO)

TransAlta Renewables has over 100 years of experience with developing, owning, and operating renewable power generation facilities. According to TransAlta’s March 2021 presentation, the company currently owns 23 wind farms, 7 natural gas plants, 13 hydroelectric facilities, 1 solar farm, and 1 battery storage, providing the company with a total of 2,537 MW of power. The majority of TransAlta’s cash flow comes from their wind farms and natural gas plants.

- Sector: Utilities

- Dividend Yield: 4.79%

- Dividend Payout Ratio: 184%

- 5 Year Dividend Growth Rate: 3%

- Dividend Increase Streak: 0 years

- Number of Years of Dividend Increase in past 25 years: 5

Readers will point out the over 100% payout ratio. This is definitely a concern but if we look at the free cash flow, the company can cover the dividend payouts. For investors that are looking for high yield and monthly dividend payments, TransAlta might be worth considering.

8. Northland Power (NPI.TO)

Northland Power is a power producer dedicated to developing, building, owning, and operating clean and green global power infrastructure assets in Asia, Europe, Latin America, North America, and other selected global jurisdictions.

The company’s facilities procure electricity from clean-burning natural gas and renewable resources such as wind, solar, and efficient natural gas. Unlike many renewable companies, Northland Power is one of the few Canadian utility companies that pay a monthly dividend.

- Sector: Utilities

- Dividend Yield: 2.92%

- Payout Ratio: 138%

- 5 Year Dividend Growth Rate: 2.2%

- Dividend Increase Streak: 0 years

- Number of Years of Dividend Increase in past 25 years: 6

Founded in 1987, the company currently has a well-diversified portfolio with over 3 GW of operating capacity. The company has a target of reaching 4 – 5 GW of renewable energy capacity by 2030. Although the dividend payout increase has not been great, the stock price has been on an impressive tear with a 5-year return of 77.9%.

Being a Taiwanese-Canadian, I was interested to see that Northland has a key wind project, Hai Long, in Taiwan. This project is located 40-50 km off the western coast of Taiwan and can generate 1,044 MW of electricity.

If you are looking for long term growth, Northland Power may be a great pick, especially when you are looking for a Canadian monthly dividend stock.

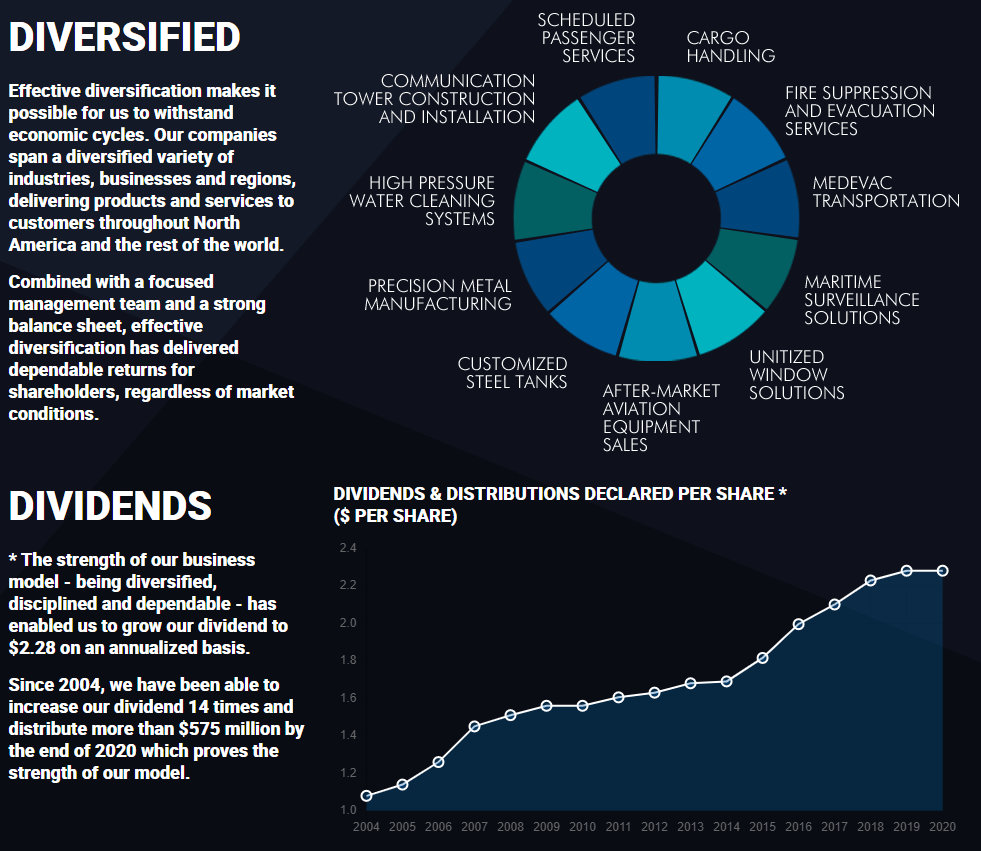

9. Exchange Income Corporation (EIF.TO)

Exchange Income Corp (EIC) is a diversified, acquisition-oriented corporation focused on opportunities in aerospace, aviation, and manufacturing. The company invests in profitable, well-established companies with strong cash flows operating in niche markets.

- Sector: Industrial

- Dividend Yield: 5.10%

- Dividend Payout Ratio: 154%

- 5 Year Dividend Growth Rate: 4.7%

- Dividend Increase Streak: 10 years

- Number of Years of Dividend Increase in past 25 years: 15

When the pandemic started, EIC made the conscious choice to continue to provide essential aviation services across their networks. Furthermore, EIC relies more on critical infrastructure providers to rural, remote, northern and Indigenous communities across Canada, rather than leisure passengers so there is some moat in EIC’s business model.

However, because EIC is in the aerospace and aviation space, the stock price crashed in March 2020 as a result. At the time of writing, the stock price has not recovered from the Feb 2020 high.

The dividends have been stable with a very decent initial yield. Although the payout ratio is above 100%, the company has sufficient free cash flow to sustain its dividend payout. The company’s balance remains strong and I believe EIC will recover from the pandemic.

Best Canadian Monthly Dividend Stocks – Final Thoughts

There are many Canadian dividend stocks that pay monthly dividends but many have not raised dividend payout consistently. The top 9 best Canadian monthly dividend stocks I picked are heavy in the REIT sector. Although REITs may have a high initial yield, they typically don’t raise dividends at a high rate. This is something to keep in mind whenever you invest in REITs.

While it might seem beneficial to invest only in monthly dividend stocks to ensure your dividend income is stable throughout the year, investors shouldn’t just limit themselves.

I believe it is far more important to pick high quality dividend stocks, regardless of whether they pay quarterly or monthly dividends. Therefore, I’d highly recommend taking a look at some of the Canadian dividend stock picks from the dividend growth investing community.

Remember, dividend investing shouldn’t just focus on a growing dividend income. I believe dividend investors should focus on both growing their dividend income and the growth of the overall portfolio value. In other words, focus on total return.

Are you looking to re-balance your portfolio regularly, regardless of whether you hold index ETFs or dividend paying stocks? Some smart folks created Passiv to do that for you automatically. With Passiv, the tool can put your portfolio on autopilot. You can build your own personalized index, invest, and rebalance all through a click of a button. Passiv can even calculate and execute the trades needed to keep your portfolio balanced. Essentially, Passive makes investing super simple! A community user account is free to sign up. The elite member account is $99 per year…but it’s free for Questrade clients! Make sure to check out Passiv.

Looking for more information? Below are some articles that you might find useful:

- Geographically diversify your portfolio via one of the low cost ex-Canada ETFs like XAW.

- Want to track your portfolio? Take a look at my Google Spreadsheet Dividend Portfolio Template.

- Learn how to read annual and quarterly reports.

- Which discount broker should you use? Check out my Questrade vs. Wealthsimple Trade review.

Note: This blog post represents my opinion and not advice/recommendation to purchase these stocks. Before you buy any stocks, please consult with a qualified financial planner.

Hi Bob. Is this your updated list for 2023. You mentioned in one of replies in late 2022 that you were planning to update. Is this it? Thanks again.

Yes it has been updated.

have you considered the A&W (or other brand) royalty income(s)?

No, I have not.

Hi There,

Would love to hear your opinion on Northwest Healthcare Properties as a monthly dividend payer.

Cheers,

Mason

Northwest Healthcare Properties is an interesting name. It has taken quite a bit of beating lately. The yield is quite high as a result. The overall occupancy rate seems decent (~97%). This REIT may make sense for some income seeking investors but probably not sure us.

I appreciate the quick reply and your take!

Thank you

You are doing good job! Keep up the research.

Hey

Just wondering as I enter the Dividend World, do Monthly Dividend stocks also qualify as possible Aristocrats? Are there any examples.

Dividend Aristocrats have nothing to do with how often the dividends are paid out. A Dividend Aristocrat is a company that has paid and increased its dividend every year for at least 25 consecutive years. Hope this helps.

Any chance of an update in the future Bob ? Thank you kindly.

Yes will plan to update this list. 🙂

I’m a longtime lurker here…thanks so much for all the useful information you post! I have a question, (don’t feel obligated to answer!) I really like the ‘dividend investor’ approach. I have a friend who is very high up in a wealth management group, who advised me to look at Blackrocks iShares XDV.T .

Whenever I run comparisons, it seems to come out very well against pretty much anything.

Have you ever looked at it? Am I missing something? I love the ease of a one stop CAD ETF for dividends…. Thank you!

That’s a very good question Douglas. Generally speaking, I like to pick my own dividend stocks rather than rely on ETFs. I have went over Canadian dividend ETFs, including XDV here – https://www.tawcan.com/top-canadian-dividend-etfs-dont/

Hi Bob, I also appreciate the great deal of analysis and putting the company’s strategy material so we get a more holistic or broader picture rather than mere stock analysis.

I also observed you highlighted the Free cash flow pay out ratio, which is interesting. This bring in a different perspective. Some companies dont look great on traditional payout ratio, however looking at FCF payout ratio which is low to moderate indicates dividends are sustainable. I request or suggest if you can do one article comparing regular payout ratio and FCF pay out ratio with examples it would be very insightful and also a good topic for discussion and sharing knowledge.

Thanks for the suggestion, let me look into that.

I’m very happy too see that your top REITs are making profits and engaged in a business to business model, dealing in the commercial sphere and not the dark side of residential apartment and rental based REITs that are affecting lives everywhere.

I am concerned about supporting and for profit long term care home in Canada though. We, much like rentals, should not being using capital investment and the commodification of lives to generate profit. Also Covid shone a bright a light on the value of lives of residents and equally the employees that work in these places. Chartwell seemed to be one of the top 5 offenders from this article?

https://www.cbc.ca/news/canada/nursing-homes-covid-19-death-rates-ontario-1.5846080

This is exactly what I was looking for!

Thanks for another great post!

You’re welcome Guillaume.

Thank you for compiling this list. It’s always nice to have your insight on a few monthly dividends. Something I will be adding more of to my portfolio.

You’re welcome.

Great summary! and good compilation of monthly dividend stocks. Appreciate the amazing hard work put in to this.

I agree that one should not merely pick monthly dividend stocks just for the monthly dividend, instead focus on high quality dividend stocks in general.

I just want to add my two cents regarding AI (atrium) and TF (timbercreek). These are unique vehicles – i.e mortgage investment corporations(MICs), which lend to commercial and residential projects. So the interest earnings and fee income gets passed on as dividends. The dividend is usually fixed or within a range (say 7-8%) with minimal capital appreciation. Its more suitable for income investors or to park funds to get fixed income with reasonable safety or moderate risk.

Thanks Sridhar, very good point on AL and TF. You’re right, mortgage investment corps typically have higher income and pass that one as dividends.

This is exactly what I was looking for; a more complete list of monthly dividend stocks on the TSX.

Thanks for your hard work!

You’re welcome Alex.