It’s a new month and that means it’s time for a monthly dividend income and financial independence journey progress update. The reason for doing these monthly updates is to keep us honest and demonstrate that it is possible to build up a sizable dividend portfolio and use the dividend income to cover our expenses. When this happens, we can call ourselves financially independent. We are doing this method rather than the traditional 4% withdrawal method because we don’t want to tab into our principals, at least in the early days of living off our investment portfolio.

September turned out to be a very busy month for me when it comes to travels. I went to FinCon19 and had a lot of fun with fellow money nerds. I also went on a few work trips. For one of the work trips, I had some free personal time and managed to meet up with good friends of mine in the San Jose area and saw their 6 weeks old twins. They were so adorable and small, I almost forgot what it was newborns were like.

The highlight of September was going to the Elton John concert with Mrs. T. Although I’m not much of an Elton John fan, I thoroughly enjoyed the concert. Elton John and his band played for almost three hours! It was incredible to consider that Elton John and most of the band members were in their 70’s. It was really neat to attend the concert as the Yellow Brick Road tour might be Elton John’s last worldwide tour.

Dividend Income – Sep 2019

In September, we received dividend income from the following companies:

- Brookfield Renewable (BEP.UN)

- Canadian National Railway (CNR.TO)

- Costco (COST)

- Canadian Tire (CTC.A)

- Canadian Utilities (CU.TO)

- Chevron (CVX)

- Dream Office REIT (D.UN)

- Dream Industrial REIT (DIR.UN)

- Dream Global (DRG.UN)

- Enbridge (ENB.TO)

- Evertz Technologies (ET.TO)

- Fortis (FTS.TO)

- Hydro One (H.TO)

- H&R REIT (HR.UN)

- Intact Financial (IFC.TO)

- Intel (INTC)

- Inter Pipeline (IPL.TO)

- Johnson & Johnson (JNJ)

- KEG Income Trust (KEG.UN)

- Magellan Aerospace (MAL.TO)

- McDonald’s (MCD)

- Manulife Financial (MFC.TO)

- Magna International (MG.TO)

- Metro (MRU.TO)

- Prairiesky Royalty (PSK.TO)

- Qualcomm (QCOM)

- RioCan (REI.UN)

- Saputo (SAP.TO)

- SmartCentres REIT (SRU.UN)

- Suncor (SU.TO)

- Target (TGT)

- Unilever plc (UL)

- Visa (V)

- Waste Management (WM)

- Wal-Mart (WMT)

- Exco Technologies (XTC.TO)

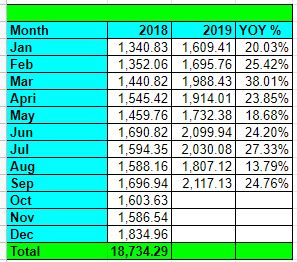

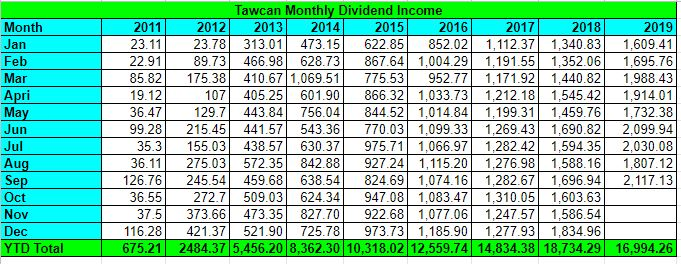

Phew, that is one LONG list! In total, we received 36 dividend paycheques that added up to $2,117.13. We have a new all-time high and crossed a major milestone! We have officially crossed the $2,100 per month dividend income milestone, woohoo! We definitely have to thank Evertz Technologies for its special dividends in September, which helped us cross this new monthly dividend milestone.

Of the $2,117.13 received, $342.84 was in USD and $1,774.28 was in CAD. That’s about a 15/85 split. Please note, we use a 1 to 1 currency rate approach. We do not convert dividends received in USD to CAD, because we want to keep the math simple. This is our way to avoid fluctuations in dividend income over time due to changes in the exchange rate.

The top 5 dividend payouts in September 2019 came from Enbridge, Evertz Technologies, Manulife Financial, Inter Pipeline, and Suncor (not in order). Dividend payout from these 5 companies accounted for $1,074.38 or 50.7% of our September dividend income total.

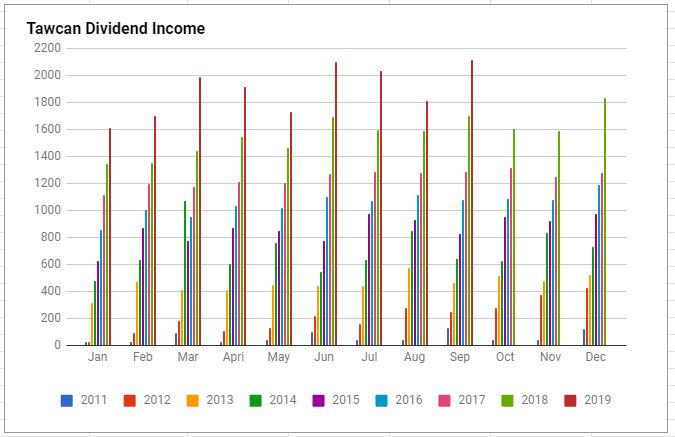

Dividend Growth

Compared to September 2019, we saw an impressive YoY growth rate of 24.76%! This is fantastic! I’m extremely pleased with the September growth performance. Hopefully we can continue to keep up the above 20% growth rate for the remaining three months of 2019.

Tax Implication

As you may know, we utilize tax-advantaged accounts like RRSP and TFSA for our dividend investments. We have been maximizing our RRSPs and TFSAs each year. Once we max out these two accounts, we then start investing in our taxable accounts.

We only hold US dividend-paying stocks in RRSPs to avoid paying the 15% withholding tax on foreign dividends. When it comes to income trusts and REITs, we only hold them in either RRSPs and TFSAs. For taxable accounts, we only hold Canadian companies that pay eligible dividends.

This is our way to be as tax efficient as possible. Our September dividend income is, therefore, spread across the three different accounts per below:

- TFSA: 32.4%

- RRSP: 37.9%

- Taxable: 29.7%

The taxable dividend income was roughly a 30/70 split between Mrs. T and my taxable accounts. Effectively, only a very small amount of our monthly dividend income is being taxed.

When I wrote about our financial independence assumption and tax calculation, I assumed a 40/60 split between the two of us, so we have some re-balance work to do still.

Dividend Increases

In September a number of companies announced dividend payout increases.

- Fortis raised its dividend payout by 6.1% to $0.4775 per share.

- Verizon raised its dividend payout by 2.07% to $0.615 per share.

- Emera raised its dividend payout by 4% to $0.6125 per share.

- McDonald’s raised its dividend payout by 7.76% to $1.25 per share.

These dividend increases have added our annual dividend income by $76.62. It’s not much money but a raise is a raise regardless.

Dividend Stock Transactions

Unlike August, the market was mostly positive in September. This meant it was harder to find discounted dividend-paying stocks to add to our dividend portfolio. Therefore, we were quiet on the purchase front.

We weren’t quiet on the selling front, though.

In the middle of September, Dream Global announced that it was to be bought by Blackstone funds in a $4.7 billion deal. According to the announcement, Blackstone will pay C$16.79 in cash for each Dream Global unit to acquire all the office and industrial property manager’s subsidiaries and assets. It is expected the deal will complete by end of the year. After paying its August distribution (payable in September), Dream Global also announced a suspension of its dividends immediately.

Interestingly, Blackstone was the same company that bought Pure Industrial REIT (AAR.UN) last year, which we used to own.

As expected, the share price of Dream Global jumped after the announcement and the share price was roughly $0.20 off the offering price. Rather than waiting until the end of the year for the acquisition to close and not get paid any dividends for three months, I decided to close out our Dream Global position completely, take the profits, and reinvest the money elsewhere. In case you’re wondering, we purchased Dream Global in early 2015 and the stock price almost doubled during this time.

I haven’t deployed the cash from this transaction yet, so I will be keeping my eyes open throughout October for opportunities.

Financial Independence Journey Progress

Our September expense was much lower than usual. Therefore, the $2,115.28 dividend income received in September was able to cover 62.1% of our total expenses in September. If we only look at necessities, the September dividend income was able to cover 81.4% of our September necessities total! Nice!!!

We are very happy to see such a fantastic financial independence journey progress for September. Hopefully, we can stay above 50% for the remaining three months of the year.

Summary

With three months left in 2019, we have received almost $17,000 in dividend income. I am pretty certain by the middle of October, we would exceed the annual dividend income total from 2018. It is amazing to see our dividend income progress and how far we have come.

At $40 per hour salary, we have already saved over 424 hours of work, or 53 days worth. That’s an equivalent of over ten and a half weeks worth of work! Our dividend income certainly has come a long way compared to five years ago.

Dear readers, how was your September dividend income?

Hi Tawcan,

Nice job! I’m around 300$ per month.

Every 300$ per month worth 120K$ investment with 3% yield, So I have a long way to 2000$ per month:) but Hey, 300$ is better than 0$.

Can you tell how do you have stocks like MCD in your list, while your investment method is buying stocks with P/E lower than 20? (It is higher than 20 for a long time).

Did you manage to buy it back then?

Also, how did you manage to raise your original investment back then in 2011? Savings? Other assets?

Have you defined a steady percentage of your monthly/yearly income for example, that you reinvest from 2011, every month? (Sorry if you wrote it somewhere and I missed it).

Cheers!

Thank you. We purchased MCD a long time ago when the P/E was much lower than now. We re-invest all of our monthly/yearly dividend income. I haven’t shared percentage in terms of our yearly income on this blog, I did share how much fresh capital we invested in the last few years in a few posts.

I am 71 and I own several REITs that pay monthly dividends so I have money coming in between my quarterly payers.

Nice Sam!

Hi Bob,

Congrats on the September achievement.

Cheers!

Thank you Odysseus.

Your ever-growing dividend totals are impressive to see, Tawcan. The 20%+ YoY growth rates at your dividend levels are outstanding as well.

Congrats on crossing $2,100 in a single month. Pretty soon it will be an every month thing!

I found your $76 addition in forward dividend income due to dividend increases to be terrific. No small amount in my mind.

I was able to cross $1,200 in dividend income for the first time this September. That’s one of the beautiful things about DGI, records are sure to come with continued investment and time in the market.

Thank you Engineering Dividends. $2,100 per month as an avearge would be pretty awesome! 🙂

Congrats on crossing $1,200 in dividend income.

I am always thoroughly impressed to see the significant progress your portfolio has experienced over the greater part of the last decade when I see these updates. Even the current YoY trends are fantastic and illustrate how dividend reinvestment and new capital that is deployed are really working hard for you!

Yup, new capital and reinvesting dividend are paying off nicely for us. 🙂

So many dividend-paying companies I am lucky if three of my companies pay a dividend in the month. But then again my portfolio isn’t this massive.

Thank you Erik. It takes time to build up your dividend portfolio. Keep at it. 🙂

Our September dividends weren’t too bad but are nothing like yours at all, wow. We don’t do individual stocks but the usual couch potato index fund ETF asset allocation. Out of our dividends I noticed that VCN has dropped payout a fair bit. I’m considering selling off my VCN as it is so heavily invested in oil and gas as well as mining and putting it all in my XAW international. More of that single fund approach like MMM and JlCollins mention.

Yea VCN is very energy and finance heavy. XAW has a good mix of sectors and is more international. 🙂

Tawcan –

That is one MASSIVE list! I would have done the same, relating to the acquisition of your company. I have been in your situation once before and did the same – they were close to the ceiling and no further dividend, so it was time and then can re-deploy elsewhere. Great work on the milestone!

-Lanny

Hi Lanny,

Thank you, glad to hear that you’d have done the same as me when it comes to the acquisition.

Nice work Bob. It must feel pretty nice to have dividends covering 60%+ of your expenses! Enjoy October.

Thank you Max, very happy with our September dividend income.

woot woot

Go Bob go.

Solid month and congrats on your new record and raises.

keep it up

cheers

Thank you Passivecanadiancinome. Very happy with our progress. 🙂

Just curious – what is your current yield for your portfolio? Also, why do you have so many different stocks? Do you recommend this many for others?

Hi Chris,

I don’t share the yield of the portfolio but you can estimate between 3-4%. Ideally I’d like to reduce the number of stocks we own but some of them we received from company spin-offs/splits. The commission would take up a large percentage of the overall transaction so it doesn’t make sense to sell, unfortunately.

Nice job Tawcan! 24% growth is nothing to shake a stick at!

I was super happy when I saw recent y-o-y dividend growth of 15% in September. We set a record for dividend income in a single month! I thought it was great!

Keep up the good work on your end! 🙂

Thanks Mr. Tako. Your 15% growth is way more impressive than my 24% growth as your dividend income is HUGE! 🙂