Ahh, the age-old debate… dividend investing vs. index investing. Is one better than the other?

Well, like any good debate, there are many of evidences that can support both sides of the argument.

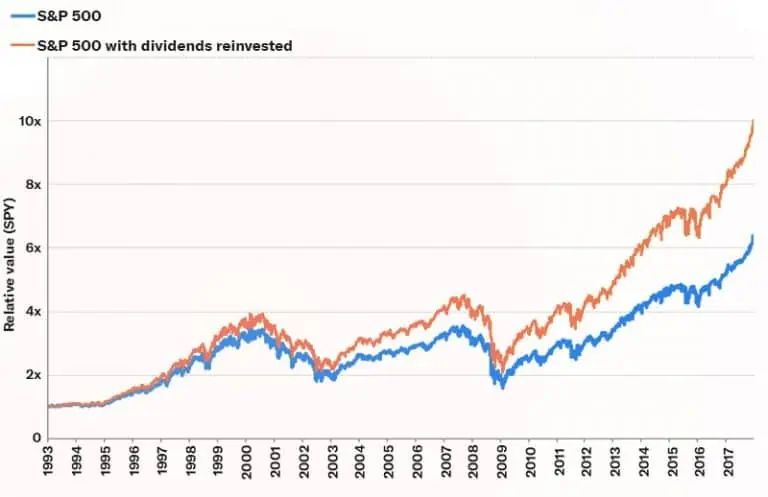

For example, dividend investors will quickly point out that over the long term, dividend stocks return better than non-paying dividend stocks.

On the other hand, index investors will point out that dividends are irrelevant.

I’m not going to argue which one is better on this post, but you can probably figure out where we stand given we are hybrid investors.

When it comes to investing, it’s super easy to just take all the numbers, plug them into the different formulas, and analyze the results to the nth degree. There have been a lot of books on how to invest based on mathematical formulas or theories.

They are all good and all, but I would argue that investing in real life is very different than running mathematical analysis.

In my short +15 years of DIY investing career, I have come to realize that investing in real life is not just about investment strategy and analysis. Rather, I believe investing in real life is about 30% investment strategy/theory and 70% psychology.

Psychology plays an important role in deciding whether your investment is going to be a success or a failure. It is also the number one reason why people end up buying high and selling low even though they should be doing the complete opposite.

When your hard-earned money is melting away faster than ice cream on a sunny day, all you care about is preserving whatever money you have left, so you end up selling low on emotion. On the other hand, when stocks are going higher and higher and you’re seeing everyone and their dogs making money hand over fist (and paw ha!), you want to get in the action as well, so you end up buying high on emotion.

I believe strongly this is where dividend investing shines and why dividends do matter. Because dividends do calm the nerves during volatile market conditions. Receiving steady dividends, regardless of how the stock price is doing, will allow investors to stay invested longer.

Take two stocks, A and B. Stock A doesn’t pay any dividends while Stock B pays a 3% dividend every quarter. All things being equal, if the price of both stocks goes down by 30%, which stock do you think gets sold more by investors?

I believe Stock A, because investors don’t see their money working hard for them. For Stock B, because of the steady 3% dividends, investors are more likely to hold on during bad times and wait for the stock price to recover.

Furthermore, if you have done really well with an investment online portfolio where you invest with a fake starting capital, I’m sorry, you probably won’t learn too many investment lessons from this experience. Why? Because most of these fake money portfolios only last a short period of time so investors end up betting on high risk high reward stocks. And since the money you’re using is fake money, who cares if you lose all of them?

Ask yourself, would you do the same with your hard-earned money?

So is dividend investing better than index investing? Well, I certainly can’t answer that question myself and whichever side you’re on, I’m sure we will definitely come to the conclusion that we will agree to disagree. What we probably can agree wholeheartedly is that dividend investing and index investing are a heck a lot better than hiding money under your mattress!

As I’ve heard many years ago – “when it comes to investing, your ego is not your amigo.” Psychology matters!

Finally, to be better investors, we really need to focus on learning more about the psychological side of investing. This is why I enjoyed reading The Bahavior Gap so much! If you haven’t read it before, please do yourself a favour and read it!

Good reads from the PF community

Enough of the silly debate, here are some great articles & videos I’ve come across from the PF community.

Dave from Accidental Fire explained why he hasn’t bothered fixing a deep scratch on his brand new car because his values are probably different than yours – “Yep, I never did. The scratch is still there to this day. I just never got the motivation to do it because I don’t care that much about how my damn car looks. It’s plain and simple. The appearance of my vehicle is just something that I don’t value that much in life. A vehicle to me is a tool to get me from point A to point B. I want it to be functional and safe. The ability to play music is nice. Oh and it has to be able to carry a few bikes, or my kayak, or a few standup paddleboards. Good gas mileage is important. After that, well, whatever. I don’t look at the public roads as a fashion runway.” I totally get Dave’s point… the longer you’re on the FIRE journey you’ll discover there are more and more things you just don’t value that much in life!

I’ve written about geo-arbitrage quite a few times and how it can potentially expedite our FIRE journey. Mr. Tako and his family moved from Washington to Arizona recently because of the lower cost of living, but as it terms out, they’re questioning is Geo-Arbitrage a Financial Fairy Tale – “I expected to have difficulties along the way, but the move was far more financially difficult than I expected. It’s going to take many months before we make-up for the higher moving costs, and the double living expenses we had to pay. If there’s one major point that I’m trying to convey here, it’s that geo-arbitrage is NOT a pot of gold at the end of the rainbow. Traveling has a cost, moving has a cost, and there are numerous taxes and setup fees associated with changing location too. One way to think about it, is like making an investment. You put up the funds first, and then slowly earn back those funds over time through lower geo-arbitraged expenses.“

Joseph Carlson reminded investors that the market goes up and down. Investors shouldn’t need to have the urge to “fix” their portfolios based on some short-term indicators like interest rates or inflation rates.

Not really personal finance related but I have learned Yvon Chouinard, founder of Patagonia is giving away the company. All profits of the company will now be used for fighting climate change – “Rather than selling the company or taking it public, Mr. Chouinard, his wife and two adult children have transferred their ownership of Patagonia, valued at about $3 billion, to a specially designed trust and a nonprofit organization. They were created to preserve the company’s independence and ensure that all of its profits — some $100 million a year — are used to combat climate change and protect undeveloped land around the globe.” Amazing! I hope more companies would do that.

J.D. Roth from Get Rich Slowly said that he lost money in crypto so that you don’t have to – “I believe that my crypto story is typical of most (although perhaps with larger amounts of money). I wasn’t investing. I was speculating. I saw people I know making tens of thousands of dollars on this new technology, and I wanted in on the action. So, despite not understanding how this all worked, I put money into the crypto market. I was gambling.“

Gean and Kristine from Fire We Go shared their August dividend income. It’s nice to see other Canadian dividend investors working their way toward living off dividends.

Monevator explained the Pro and cons of being wealthy – “Buy a country house and you need staff. Invest your millions and you need accountants. They might move your money offshore, and now you don’t understand the taxes. Perhaps you’ll go to prison for tax evasion? But you’ve no time to read up, because three different architects are coming over to quote on your summer home. You need to brief the security guy about that. Except he’s getting off with your disinterested wife in the boat shed. You think you’ll be different? So do I. Didn’t they?“

Physician on Fire asked Is the wealth effect making you think you’re rich – “So, what should the investor do to combat the wealth effect? The same thing they always need to do. Stay the course. If you’re still a decade or more away from retirement, just stick to your written investing plan. Keep your 60% (or whatever) stocks in bull markets and in bear markets. Don’t get greedy and abandon bonds, especially out of an irrational fear of some bond bear market. Do not start spending more or buy a bigger house because your balances seem large. Remember that a significant chunk of your investment account isn’t really there.“

That’s all for good reads from the PF community this time around. Have a great weekend everyone!

Thanks for the mention Bob! I’m honored to be included among other great writers, like yourself!

You’re welcome.

On days like today, dividend stocks really maintain your confidence. Across all portfolios we have about 120K in dividends a year, but some not as tax efficient as others.

Looking back over the last 2 years , I could have sold some capital gains but then who really knows the best time .

As 70% are US ADR’s , with the increasing exchange rate I’ve done well on paper.

However I do have a lot of US$ cash waiting to buy in my dual currency accounts. But there is the problem. C$ cash can get 4.2% in a safe GIC sitting on the sidelines. But all Canadian banks only offer maximum 1% on US$ cash in term deposits.

So unless I can find a US$ term deposit that offers higher interest, I’ll have to find US stocks or ADR ‘s that pay good dividends.

EU and non- US stocks are looking severely beaten down and would be good quality buys for the long term as everyone knows , the market cycles and it’s how the wealthy stay wealthy by finding beaten down stocks at bargain prices

I think there are some excellent buying opportunities ahead!

Thanks for sharing this Bob, yes….the psychology of investing is what leaves many investors in ruin. You are exactly right, the market goes up and people FOMO in (Fear of missing out) but they are buying at elevated prices. People should be buying when everyone is fearful…..Like Now!

Exactly. 🙂