Recently I was featured in an article called “Experts say dividend-paying stocks are not for everyone.” Since the article is by The Canadian Press, it appears on many different sites and I certainly had my two minutes of fame.

In the article, Robb Engen from Boomer and Echo pointed out that dividend investing isn’t for everyone and that most Canadians are better off focusing on growth by investing in index ETFs.

So, is dividend investing stupid?

To be perfectly honest, I’m really tired of this age-old index vs. dividend investing debate. You can find strong reasons and points for both sides. Can’t we agree that investing in either index or dividend stocks is far better than hiding your money under your mattress?

For the most part, I do agree with Robb. For most Canadians that want to invest passively and have peace of mind, it is easier and more straightforward to invest in index ETFs, like the all-in-one ETFs or all equity ETFs. If you want to do a more hands-on approach by investing in dividend stocks, either do a 50-50 ETF & dividend approach, or a mix that you’re comfortable with. Pick 10-20 dividend stocks using the be an owner narrowing down strategy.

- How to Start Investing in Dividend Paying Stocks

- How to start dividend investing with as little as $1,000

Having said that, I truly believe it’s important to remember that personal finance is personal. Take mortgage, for example, some people prefer paying off their mortgage as quickly as possible while some prefer using a mortgage as a way to execute Smith Manoeuvre. Is one more correct than the other? I don’t think so.

Similarly, when it comes to investing, I do not believe there’s a one size fits all solution. We all know that some people prefer real estate, some prefer index funds, some prefer dividend stocks, etc. Since we all have different personal circumstances, what you invest will come down to personal preference. Bluntly saying that dividend investing is stupid and that dividend investing means ignoring total return just seems silly to me.

Let’s not forget that we are hybrid investors –we invest in both dividend stocks and index ETFs. So we not only care about a stable dividend income, we care about overall investment returns too!

Good reads from the PF community

Here are some good reads I’ve come across from the personal finance community. Enjoy!

Chrissy and her husband M retired last November. She asked if they retired at the worst possible time? I really appreciate her honesty and details in her post – “Now that I’ve shared the ugly truths and all the mitigations we’ve put in place, it’s time to discuss the elephant in the room: do we regret our decision to FIRE when we did? Both M and I can honestly say, “NO WAY—not for a second!” Early retirement has been amazing, especially for M.“

Mr. Money Mustache posted for just the second time this year and his latest post was a good one: Finally a stock market crash! – “This has in turn triggered the more skittish stock investors to run for the exits and completely change their view of our economic future, flooding the financial news with red ink and scary headlines. The bottom line is that the overall US stock market is down about 20% over the past three months. Which means that if you add up your net worth as I do occasionally, you may find that almost a fifth of it has suddenly gone up in smoke. Fortunately, this is just an illusion. While the human side of every war is awful and you should help out if you can, the financial side of this panic is very normal and we were overdue for something like this to happen.“

My heart goes to all the innocent kids and teachers that lost their lives in the recent school shooting in Texas. I do not understand why it’s so easy for people to get assault-type weapons like the AR-15 in the states. Tanja was fed up with the latest news and wrote a great article called What you can do about guns when leaders fail us – “If you own shares of gunmakers, which you absolutely do if you hold standard market index funds, figure out how to go to the shareholder meetings and then get loud. Demand that gunmakers stop putting profits over lives and insist they stop making assault rifles. Organize protests outside of shareholder meetings. Most shareholders have never had to hear from the public on this, so get loud and make them squirm. Activist shareholders have succeeded in redirecting companies away from harmful acts, they have succeeded in getting activists voted onto boards of directors, and they have succeeded in ousting leadership. Everything is on the table, so bring the fight directly to the company and make them do better.“

Speaking of gun control, I think Japan has the right idea. Did you know that in 2015 only six shots in total were fired by Japanese police?

GYM at Gen Y Money shared a few ways on how to save on groceries in Canada (despite crazy inflation) –“You’ve probably heard about this before, but shop the perimeter and ignore the middle part of the grocery store. This is one way on how to save on groceries in Canada. The middle area is where all the higher priced stuff is housed anyway (not to mention groceries that aren’t really “food” aka packaged and highly processed foods).” Some readers may recall that last year I compared Costco, Walmart, and Superstore to find out which one is better at keeping prices down despite inflation.

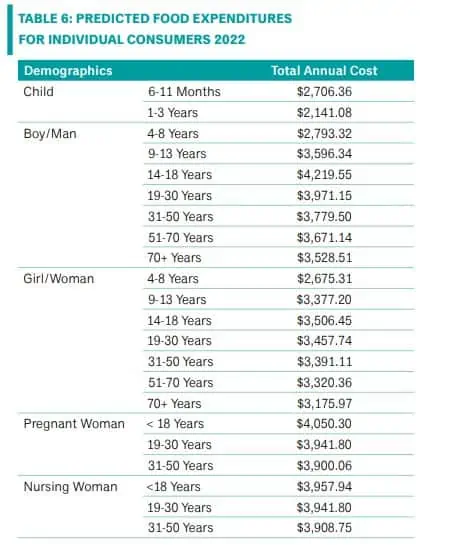

Thanks to GYM’s article, I stumbled upon Canada’s Food Price 2022 Report. I found the two tables below particularly interesting.

Based on this report, our household would spend $13,442.26 on food in 2022. This translates to $1,120.19 per month or about $3.07 per meal per person, not including dining out. For comparison, last year, we spent $1,178.14 per month on groceries or $3.23 per meal per person. If we include eating out, on average we spent $4.13 per person per meal in 2021.

One thing to keep in mind is these numbers from Canada’s Food Price report are simply estimates. Since we try to eat organic food as much as possible, it makes sense that our food spending would be slightly higher. However, the price report does provide a good starting point for comparison purposes.

I have really enjoyed watching Joseph Carlson’s videos. Here’s one where he went over why Costco is doing better than Walmart and Target.

Despite the fact that we’re living in the 21st century, we still face a lot of discrimination on a daily basis. Bitches Get Riches wrote about 7 ways our society financially punishes single people – “Many, many disabled people have no choice but to stay single, despite being happily committed to a partner. It’s because we baked shame, skepticism, ableism, and eugenics into the fabric of our laws. It’s disgusting and shameful.“

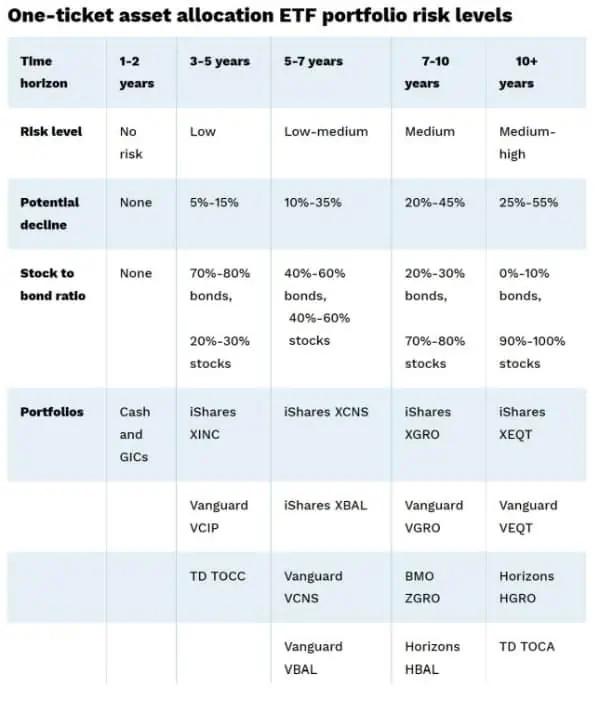

Speaking of ETF investing, Dale at Cut the Crap Investing updated his ultimate asset allocation ETF portfolio page

Jim from Route to Retire wrote about the 3 attainable characteristics that drastically improved his quality of life – “What I am saying is to consider doing something new and different in life. Maybe that’s something adventurous like white water rafting or going on a safari – or even something like bungee jumping.“

I hope you enjoyed reading these articles as much as I did.

Have a great weekend everyone!

Thank you Bob for sharing and allowing me the indulgence to vent

I have never understood the comparison or argument of DGI vs Growth Investing. While the destination may be the same, the goals and what you measure performance to are completely different. One is generation of cash flow the other is a pile of cash, one is measured by 7 to 10% DG and the other is 7 to 10% total return.

Effectively, they are two different philosophies in investing. One incorporates dividends and dividend growth as a core content of their investment decisions, the other, incorporates a hopeful increase in capitalization and share price value. One interesting measure is that if the company is growing their dividends, it must be sustainable and be in the domain of a growing revenue and earnings portfolio. Without a sustainable Dividend it’s all smoke and mirrors. From my perspective the academic reality is that the ‘comparison’ is in the investment of a sum of money, the differing factors is the philosophy of investing, which there are many many philosophies. Personally I invest in companies that have a sustainable earnings stream and it also reward their shareholders for the risk capital. Seek safe harbour …. happy investing ! JamesV

I am a retired DGI and I only have good dividend growers stocks in my investment accounts.

I am happy and I sleep very well at night, waiting for my stocks to work for me and get the dividends regularly.

Instead of using fear for the new investors, they shall just educate them enough so everyone can make his/her personal choice in investing.

Thanks for your articles, I like to read them.

Thank you, it’s always nice to hear from someone that’s ahead of us on the FIRE journey.

I saw that article in the Canadian press. It was good exposure for you. I’m a DGI myself. And similar to you, I do hold a index ETF for diversification purposes. And… of course it pays out a distribution. I agree that personal finance needs to be made personal again. There is way too much of the one size fits all. I don’t think anyone would like a pair of shoes 3 sizes too small or big

Love your shoe analogy. Totally agree.

Good article Bob thank you for your time! . Interesting perspective on guns you have. It’s much like the Ying and Yang” of index investing versus dividend investing. If you look at history, the first thing tyrannical governments ( or soon to be ones …) do is go after the guns from law-abiding citizens in the name of “the children ” .Mao did this in 1949 ( 70 million died under his push for socialism !) , Hugo Chavez, Pol Pot , Hong Kong just recently ,… The world is full of examples of taking away guns from law-abiding citizens. It is purely ironic that the most dangerous place in the western hemisphere to get shot is indeed Venezuela. Yet Venezuela has a strict ban against law biting citizens owning and retaining guns or bullets. This is a paradox indeed. In the case of China, there was absolutely no way to resist Socialism in 1949, as firearms were confiscated from law abiding citizens in China. The penalty was death if you were caught with a firearm outside of government army and agents . I don’t think this is healthy. It proved a disaster for the citizens of china and zero ability to fight back against “The Peoples Army”. Switzerland is a good example where most households have as you say, assault type weapons, in their house, but rarely is there cause for concern from these law-abiding x conscription people. In Switzerland has mandatory service to their army for a period of time during school or after graduation. Most candidates elect to keep their gun after they are discharged from their ‘service time’ . If you ban , worthy firearms from the law-abiding population you we’ll have another Mexico. This is where only the corrupt government and the various dangerous drug cartels have worthy weapons and law biting citizens have nothing. the AR-15 , it’s basically a semi automatic long gun, much like a Ruger or other semi autos. It just appears to be an “assault rifle” as it mocks a look that a m-16 or AK47 has . Its a basic semi auto long gun. It’s a debate that deserves deep and reflective consideration. With the example of the United States and Switzerland in comparison, when would have to determine there is much more going on than pure firearms. There is something socially wrong with United States and it deserves a congressional hearing at least, and moreover a deep sociological study into what is driving this evil in United States . With a southern open border in United States, and guns and drugs being currency, it is foolhardy to think that illegal guns could be banned in the western hemisphere. Its nice to see to hear the US government politicians wants to ban weapons …BUT their security details, are armed to the teeth with “assault weapons ” for them ! …but thy don’t want you to have the ability to protect your family – even with a BB gun . Just my two cents , a realize there are many views on the subject !

It’s an ongoing debate that’s for sure. Given that the US keeps having mass shootings, especially in schools, while other countries rarely have mass shootings indicates that something gotta change in the states.

Exactly my point. There’s something wrong with the United States sociology, polarization and tribal mentality; with gun ownership is very high in other countries they don’t seem to have the problem( tons of stabbings in London,Manchester, Liverpool though . For example, I think there was about 300 shootings in Detroit alone Since January ( so about 30 each month ), and thats just Detroit ( not even going near south LA, or Baltimore etc ) . Out of the 300, Detroit report 95% were from illegal guns and further Black on Black violence. Get control of the drug trade and illegal guns and you have a fighting chance at stemming the flow. One interesting point, Mexico rarely publicizes their mass shootings, along with many other Third World nations. Bad for tourism. Venezuela, never publicizes their mass shootings as well, bad for the optics of socialism and tyrannical government. One can take away the guns from law-abiding citizens such as Mao did in China, but this obviously won’t stand with all of the illegal gun trade and the guns on the street. The fix is found in sociology, some value of family, having a father figure in the house, and many other factors. Sociologically, it is interesting that mass shootings never used to be a problem over USA history up until more recent times. They probably are some answers here as well. My undergraduate was in Socio-Economics so I do take an interest in the store stuff … have a great day in the markets guys ! , with the sell off continuing and the economic landscape looking quite dull ( depression /recession) their are some ‘sales’ and good buys appearing ! My best to you all …. JamesV

I saw this Ben Felix video published yesterday about dividends take a look.

https://www.youtube.com/watch?v=4iNOtVtNKuU

Yes I already came across that video. Thank you.

Hi Bob—I wouldn’t say that dividend investing is stupid. But as you say, it’s a very personal thing. Each investor needs to know themselves and pick the investment style(s) that suit them and their temperament best.

Math is one thing, but psychology is just as important. The Smith Manoeuvre makes sense on paper, but for many people, it would be a psychological nightmare! Again, as you’ve said, it’s personal and we each need to work with our own psychology when investing.

Congrats on your feature in The Star! And thanks for mentioning my post.

Haha, it’s a catching title that’s why I used it. 🙂

Thank you and you’re very welcome.