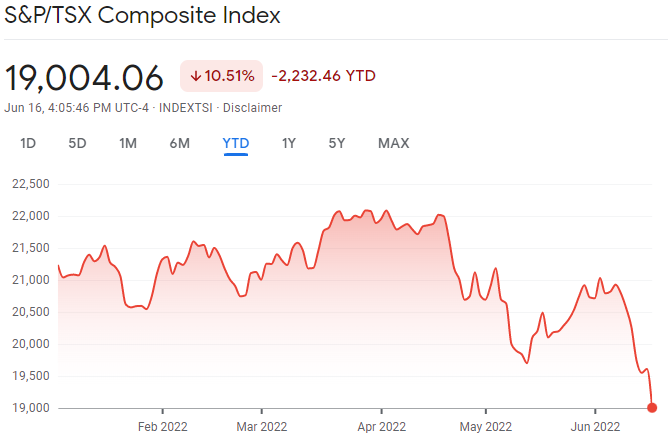

Unless you’ve been living under a rock, you probably have heard that the stock market is crashing. Year-to-date, the S&P 500 is down by 23.55% and the NASDAQ is down by 32.76%, and the Russell 2000 is down by 27.4%. The TSX YTD performance of -10.51% actually doesn’t seem too bad when we compare it to its US counterparts.

I’ll be frank. It’s tough to be an investor right now. Every day your portfolio value is probably down compared to the day before and when you check your net worth at the beginning of each month (if you check that often), it is shrinking fast like an ice cream cone inside a kid’s mouth.

When the market is crashing and you’re losing your hard-earned money on paper, it can get really tough for investors. Some investors are probably losing sleep because of the beet-red stock market and want to sell everything and hide cash under their mattresses.

Back in February 2020, when there were a lot of uncertainties and fear over the COVID-19 pandemic, the market tanked too. But as the uncertainties and fear cleared away, the market recovered and went for an amazing run.

I’d say the current situation is entirely different than what we saw in Q1 2020. The key driver of the stock market crash is the high inflation rate.

Battling high inflation rate

Because interest rates were very low throughout 2020 and 2021, as pandemic restrictions started to lift and pent-up consumer demands for travel, cars, electronics, food, fuel, etc increased, this caused the inflation rate to rise quickly. The Russian invasion of Ukraine caused the price of oil and some commodities to soar further, which drove the CPI even higher.

Inflation rose 8.6% in May in the US, the highest since 1981 – more than four decades!. Here in Canada, we saw an inflation rate of around 6.7% in the same period. This is causing a lot of fear and angst. Both the Federal Reserve and the Bank of Canada are hiking interest rates quickly in an attempt to try to tame the high inflation rate.

Are we going to see the inflation rate start to go down quickly? Or are we’re now battling hyperinflation?

I don’t believe we’ll see hyperinflation like post-WWI in Germany and I think there’s no appetite to see inflation rates in the teens like in the early 80s. The central banks will simply not allow that to happen under their watch. But I have my doubts that the inflation rate will start to go down quickly.

I believe interest rates are still way too low and both the Fed and the BoC should be raising interest rates more aggressively (the Fed did hike interest rates by the biggest amount (0.75%) since 1994 recently). Can we agree that the central banks were too slow in reacting to the pandemic recovery and the pent-up consumer demands? Interest rates probably should have gone up last year but didn’t because there were still a lot of pandemic-related uncertainties.

One thing to keep in mind is that the Fed and the BoC are being very careful about hiking interest rates too quickly. Since many people purchased properties during the past couple of years in a heightened housing price period, some of them do not have additional cash each month to pay for higher mortgage interests. If the Fed and the BoC start to raise interest rates too quickly, this can cause people to default on their mortgages, creating a housing crash, similar to what we saw in the US during the financial crisis. (Apparently nearly 1 in 4 Canadian homeowners ay they’d have to sell their home if interest rates rise more, according to a survey)

Interest rates also impact the unemployment rate. As interest rates rise, companies may decide to freeze hires and lay off people to reduce operational costs and company debt levels. As people lose their jobs, they won’t spend as much money buying things and may have issues paying off mortgages and consumer debt. High unemployment rates also hurt the country’s GDP.

As you can see, interest rates can create a lot of cascade effects and this is why monetary policy can be a very interesting topic.

So what’s my guess when it comes to the high inflation rate? My guess is that the high inflation rate will peak and flatten out later in 2022 or early 2023 before it starts to trend down to the inflation target rates in late 2023.

That’s just a pure guess on my part. As we all know, it is nearly impossible to predict the future.

How do interest rates affect the stock market?

How do interest rates affect the stock market?

Well, as interest rates go up, the yield for new bonds also goes up. Since bonds are safer than stocks, once bond yields reach a certain rate, bonds become more attractive to some investors and money starts to shift from the stock market to bonds. As people sell their stocks and buy more bonds, this puts pressure on the stock market (remember, stock prices are determined by demand and supply).

Furthermore, rising interest rates mean it is increasingly expensive for businesses to take out loans. So rising interest rates typically have a negative impact on companies that require a lot of new capital to grow. Tech companies usually are considered in this bucket, hence we’re seeing the likes of Amazon, Google, Tesla, Apple, and other major tech companies’ stock prices dropping like stones in the water.

Warren Buffett has repeatedly compared interest rates to gravity, as they represent the risk-free rate of return available to investors. This in turn affects the relative value of other assets. Since high interest rates make borrowing money more expensive, leveraged bets are therefore discouraged.

“The most important item over time in valuation is obviously interest rates,” Buffett said last year. “If interest rates are destined to be at low levels. … It makes any stream of earnings from investments worth more money. The bogey is always what government bonds yield.”

At first glance, high interest rates generally would lead to bad market performance. But if rates were kept high, companies and investors adjust to the new norm and the market would adjust accordingly as well. So as we’ve seen in the past, just because the interest rates are high, it doesn’t mean the market can’t have high returns.

Our portfolio is taking a beating

As you’d expect, our investment portfolio is taking a beating, HARD!!!

Since late March, our dividend portfolio is down around $200k. If we include all of our investments like kids’ RESP, my work’s RRSP, and our growth portfolio (i.e. more speculative stocks, it’s less than 5% of our overall portfolio), we are down over $250k, possibly more.

I hope by sharing our portfolio loss will put your losses in perspective. However, remember, these are all ‘unrealized’ losses as nothing has been sold. It’s all on paper. They only become ‘real’ – of course – if you sell and realize the losses.

And we ain’t planning to sell any stocks any time soon.

If I look at our dividend stock purchases so far in 2022, we are down by about $8,600 or about 10.3% at the time of writing.

| Ticker | Gain/Loss $ | Gain/Loss % |

| SRU.UN | -$1,156.67 | -17.76% |

| GRT.UN | -$1,734.36 | -26.21% |

| ENB.TO | $559.4 | 3.41% |

| AQN.TO | -$315.9 | -4.61% |

| BEPC.TO | $89.43 | 8.51% |

| AAPL | -$695.51 | -25.05% |

| CM.TO | -$561.49 | -21.60% |

| BCE.TO | -$520.77 | -12.75% |

| POW.TO | -$884.48 | -14.58% |

| BMO.TO | -$1,254.39 | -14.01% |

| AAPL | -$258.41 | -22.11% |

| SBUX | -$168.05 | -19.15% |

| BMO.TO | -$320.7 | -14.48% |

| BMO.TO | -$194.7 | -12.30% |

| BNS.TO | -$51.29 | -2.52% |

| BCE.TO | -$228.95 | -11.75% |

| BCE.TO | -$256.53 | -11.23% |

| COST | $35.77 | 4.12% |

| CM.TO | -$314.07 | -8.10% |

| AAPL | -$224.84 | -13.58% |

| XAW | -$162.06 | -4.84% |

The one silver lining is that our dividend income remains stable and is growing organically every month. Regardless of which side you sit on the index vs. dividend investing debate, I think we can all agree that seeing a stable and steady dividend income each month is a big boost psychologically.

Am I worried that most of our 2022 purchases are in the red right now? Not really. Since all of these stocks that we purchased are solid and highly profitable companies and aren’t going bankrupt anytime soon, I continue to believe the stock prices will eventually recover and roar higher.

For example, Apple will continue to make billions of revenue each quarter. People will continue to buy iPhones, Macs, AirPods, and apps from the Apple store. Apple is not going to not make money all of a sudden because of rising interest rates.

Let’s not forget this is exactly what we saw in 2020. Many of the stocks that we bought back then were down significantly for many months after our purchases. But eventually, these stocks recovered as you can see below.

| Ticker | Purchase Price | Current Price | Gain/Loss $ | Gain/Loss % |

| BMO | $77.63 | $126.39 | $2,779.43 | 62.81% |

| BNS | $53.26 | $79.39 | $2,665.73 | 49.07% |

| CM | $37.81 | $63.73 | $6,013.59 | 68.56% |

| CNR | $118.29 | $140.03 | $260.84 | 18.38% |

| CU | $32.40 | $37.10 | $201.98 | 14.50% |

| ENB | $38.72 | $52.98 | $5,334.48 | 36.84% |

| GRT | $67.11 | $76.40 | $250.85 | 13.84% |

| NA | $65.54 | $85.61 | $1,003.50 | 30.62% |

| PEP | $135.94 | $157.03 | $421.86 | 15.52% |

| RY | $84.60 | $124.77 | $1,044.32 | 47.48% |

| SU | $30.63 | $47.66 | $2,009.57 | 55.60% |

| TD | $63.11 | $86.17 | $7,379.43 | 36.54% |

Above is just a small selection of the winning stocks we’ve bought in 2022. I can tell you that not every stock we purchased back in 2020 was a winner. We certainly bought some losers like Inter Pipeline, Algonquin Power & Utilities, and Brookfield Renewable Corp, to name a few. But the important thing is that overall we are up by over 22% if we look at our $115k purchases in 2020.

Remember to look at the big picture

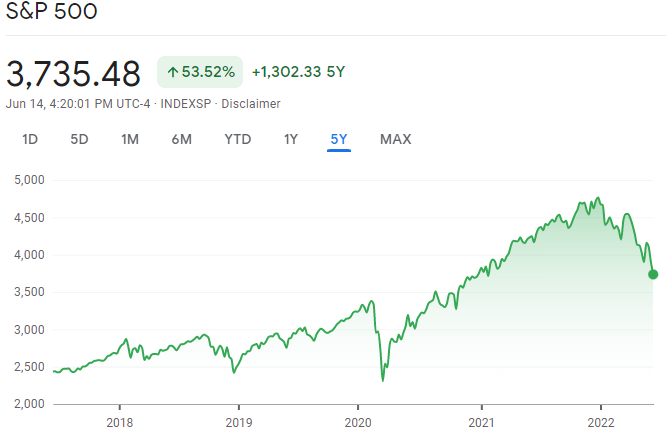

During volatile times it is important to remember to step back and look at the big picture. Remember that the S&P 500 is down 23.55% year to date? If we zoom out to the 5-year view, the S&P 500 actually returned +53.52% over the last five years.

Similarly, the TSX has returned 28.67% over the last five years.

The current “bear” condition looks like a very small drop when we step back and look at the big picture.

If we zoom out even further, this current bear condition looks like an even smaller flip. And as you can see, since 1979, there have been a lot of these flips where the market dropped by a few percentages. As a matter of fact, the steep drop in March 2022 isn’t as scary and steep when we look at the big picture.

If you had invested in the TSX index in 1980 and held it ever since you’d be looking at more than a 540% gain!

So what’s my key message to investors that are worried and are losing sleep because of the current scary market condition?

If you’re investing in passive index ETFs, understand that you’re tracking the market performance minus fees and expenses. So as the market recovers, so will your portfolio. If you’re investing in dividend paying stocks or high growth stocks, invest in companies that are highly profitable, have a high return of equity, and have a wide moat. Always focus on the fundamentals. Furthermore, remember that real cash flow matters. If a company isn’t generating free cash flow that should raise warning lights, especially in a high interest rates environment.

One more point… we investors need to remember to remain patient. Companies like Apple and Costco may not generate as much profits as Street’s expectation every single quarter but as long as they are growing revenues and profitability over time, shareholders will eventually get rewarded.

What we’re doing in this bear market

So what are we doing in this bear market environment?

Long time readers will remember I’m a true believer in time in the market rather than timing the market. Since we are still in the accumulation phase, we plan to continue to add new cash and buy dividend paying stock regularly. I continue to like stocks like Apple, the Canadian banks, Costco, Algonquin Power & Utilities, Brookfield Asset Management, Brookfield Renewable, Waste Connections, Fortis, Metro, Telus, and BCE, to name a few.

More importantly, we will continue to spend less than what we earn, continue with our relatively high savings rate, and have multiple income streams whenever possible. Saving money each month and having the ability to deploy that cash saving to purchase stocks is extremely powerful.

Also important is that we will continue to keep an eye on our spending trend and avoid lifestyle inflation. Before we make a big purchase, we always ask if we really need the item. Having some cash savings as a cushion will come in very handy in volatile times. Some people recommend having an emergency fund equivalent to three to six months of your expenses. But I’d argue that amount depends on whether you have any consumer debt, mortgage, your average monthly savings rate, and how secure your job is. For us, we are probably looking at around two to three months worth of saving.

Dear readers, what are you doing in this bear stock market environment? Are you doing anything differently?

This one is definitely resonating more than previous downturns, likely because I have more money invested than ever. Which will also be the case during the next downturn, and the next downturn… first-world problems a bit, but that doesn’t make checking those accounts any less painful in the meantime haha.

The situation right now is concerning for all – be it first-timers or seasoned investors or even for professionals in the stock market.

Although we recovered well from pandemic crash in 2020, another one is happening and it may pass off sooner or it may grind on for several months.

If someone is in fear this situation highlights the importance of overall financial planning in which investing piece is one part. Firstly, if one invests in equities its for long-term so one should not worry about fluctuations but easier said than done. Secondly you need to have emergency funds, savings, etc put aside separately for immediate or mid-term needs. Thirdly if you are investing purely for price gains, you are not an investor, just a speculator (exception is professional full-time trader for how price gains make sense).

The only way is to either ignore the market if you feel bad or affected and focus on other things in life and come back later – Take a Break!. Or if you are the value investor kind and have the money to pick good companies you can do that. Or if there are other financial aspects thats affecting you like credit card dues, mortgage outstanding, etc its time to focus on that because that would help you recover from the situation when economy comes back up in a few months time. These are just my general thoughts on how to approach but this can differ depending on the individual situations.

Great points Sridhar!

I have never really changed my investing style over the past decade plus some. What I have changed, during these very volitle times (2020 crash and current), is “trading” a small portion of my portfolio with value stocks. Basically taking short positions in them. Once they hit my target, I cycle the money back into my DG portfolio. The big disadvantage with that in a non registered account is all the capital gains I have to pay that year. However, it has boosted my portfolio by 2-3% total return. Value stocks with strong fundamentals tend to outperform the general markets eventually i have noticed. I did that with cyclical oil companies in Canada. I don’t like holding them long term though. I also trimmed my holdings in td and cm when they were at all time highs in february, not supported by fundamentals (40% gain over previous all time high without a proportional gain in earnings/revenue).

Check out this two simple trading options.

Cash Covered Calls since you have owned the stocks. I learnt it about a year ago but was sceptical but finally has the courage to do covered calls for the stocks which I owned all along.

I started selling some CC at a price I am comfortable to let go and at the time of writing, most of CC that I wrote will go unassigned at expiry dates since the market has gone down the last few months.

And since the market downturn, I started to sell cash secured puts for those stocks that I wanted to buy at the strike price that I would want to own ( 10-15% from current price ) and if they stay out of money ( OTM ) , I will just collect the premium. If they stay in the money ( ITM ) , I will just own the stock at a favorable price than if I had bought outright from the market.

Again this is just my thoughts which I learnt after almost 2 years of investing and reading/learning.

Right or wrong – it depends on individuals but what I know is that even when my portfolio is down a bit, I still collect all these premiums which helps cushion the fall.

Hi Bob,

Since basically a buy and hold investor, do you ever consider the following strategy below :

1. Do Cash Covered Calls on the stocks that you are holding for those which are showing unrealized gain ?

2. Do Cash Secured Puts

Just my thoughts only

Hi Gary,

I have thought about utilizing options to generate more income but haven’t got into that because it seems very time-consuming to me. Also in many ways, you begin to speculate.

I do like to think of my portfolio like owning rental property. It doesn’t matter if the property is worth more or less – it’s really only important that it generates a stable income. Of course, it’s not good when prices drop enough to warrant a dividend cut or hiatus. But this usually helps me to sleep easier when the markets are volatile.

That’s a good way to look at things. It matters how much the property is worth when you sell it. This is the same for stocks.

There’s a lot more downside coming up. The effects of Years of QE and low interest rates will not go away in 3 months . I’m holding off buying any stocks and accumulating cash until inflation and interest rates peak.

The good news is we’ll keep our lifestyle costs down as with all the travel chaos and inflating travel costs we won’t be getting gouged and risk going on a vacation for some time. Our annual luxury vacation for 2 weeks to Hawaii before Covid was about $10k, prices for the same vacation are about $20K! And that’s with a moldy smelling mountain view room . Forget it

Thats very wise.

Keeping your lifestyle cost down is important. Wow, double the cost for a 2 week Hawaii vacation? Talk about inflation!!!

Thanks for sharing how much you are down.

Nice to have cash flow to buy more each month, as I liked to say “cash rules everything around me”

I just put in more money into my brokerage account, have a bit of cash left but I anticipate to need more hah.

Having cash flow is nice in times like this. 🙂

I don’t plan to miss the opportunity to buy some longer term GIC’s during this interest spike. If I can take some sidelined cash and drop it into a GIC that will pay 5+% for 3-5 years, I will do it. That is, if inflations doesnt become a double-digit issue

If you’re planning to do that, doing a GIC ladder might be a good idea. Having said that, I wouldn’t lock in for long terms since I expect rates to continue to go up

I have a feeling that Mirza has already been slaughtered!

I am already retired and have 13 stocks in my portfolio all of them are DRIPs. We live off my wife’s RRSPs all invested in Balanced Mutual Funds (it really irritates me but sometimes we have to compromise).

My anticipation is that over the coming months I will accumulate a good number of shares through my drips.

Let’s please be nice and civil here in the comment section. 🙂

Dripping shares at a discount is great!

Fortunately not (yet). Im also conservative and invest in blue chips so my investments have returned decent growth considering that I started investing around 2006 and experienced some severe economic events in the past 2 decades.

The stock market is a playground for the rich to play. Its heavily manipulated to boost or deflate stocks. Narratives are built to support the movements in the stock market. Media is the number 1 weapon of the rich in manipulating the markets.

Hyperinflation was post-WW I in Germany, not post-WW II.

Thanks for pointing that out. Fixed.

Yeah, my portfolio has also taken a beating in value. Still, I am in it for the long haul.

I still plan on saving and buying. In fact, I am just about ready to make some new stock purchases. Bear markets are good times to load up on great stocks at a discount. Going to lock in some nice yields. That’s my plan. 🙂

Exactly, bear markets are good for ppl that are accumulating.

This time it looks different. I fear a depression era situation coming up for stocks. The lambs are going to get slaughtered.

I’m a wolf in sheeps clothing & I’m hungry